Holding Firm: Why Thermoskin remains committed to manufacturing in Australia

Developed three decades ago by sporting aficionados looking for a way to quickly heal their aches and pains, Thermoskin has grown into an export success story.

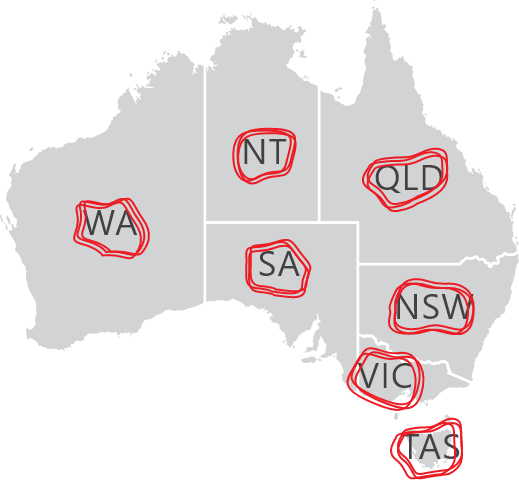

The Australian brand, which is United Pacific Industry’s key earner, is sold in 18 countries, and is the market leader in quite a few, including here at home.

The state-of-the-art medical heat bracing aids are designed in Australia. What’s unusual about them is that they’re made in Australia too.

The company makes nearly half of its products from its base in Melbourne’s east, which houses the company’s administration, manufacturing and warehousing all under the same roof.

It’s a strategic decision with moral dimensions, United Pacific Industry’s CEO Matt Symington tellsSmartCompany.

Firstly, it’s about speed to market. “We feel we gain an advantage over our competitors through our quick product development,” Symington says. “We can turn around a concept – an idea – and bring it to market within six months. And that’s because we can develop the products internally without our production area. We can then test and trial them at Victoria University, who we have a relationship with.

“Another value-add about local manufacturing is it means we can offer our customers custom-make services. Not everyone fits into a small, medium or large. We do have sizing guidelines for our products, but for specific fits – especially for knee injuries and the like – we can have someone call up and say, ‘I have quite a large calf, so I need an adjustment there’, and we can make it for them. And that’s used quite frequently.”

Manufacturing locally also means United Pacific Industries can tap numerous export and textile-specific government grants, which it has used in the past.

And lastly, it’s about keeping the staff. Some of the machinists working for Symington have been with the company for 20 years.

“I think businesses these days are too busy looking at the bottom line,” he says. “Don’t get me wrong, we look at the bottom line. But we also look at how we’re engaging your staff, and their loyalty to us. We want to provide an environment where they can flourish. As I said, we’ve got a lot of long-term staff, and I hope that’s because of the culture we have.”

Even though it makes strategic sense, manufacturing in Australia would have been impossible without the foresight of Thermoskin’s founders.

“Our inventors did the right thing in setting a premium price,” Symington says.

“You can certainly get a knee brace for a lot less than ours. But we’ve been able to market our product for more than 20 years based on a premium price point, and also on the efficacy data that we have.”

Thermoskin was developed in the mid-1980s. Shortly after being invented, it was bought up by global pharmaceutical and skincare giant Johnson & Johnson. The multinational only held onto it for a few years. In the late 1980s, Johnson & Johnson bought in consultants to rationalise its global brands. One of these was Maurie Callinan, who figured Thermoskin had plenty of potential that wasn’t being properly realised. Together with a few others, he raised enough money to buy the brand of J&J, and in 1991, United Pacific Industries was born.

Today, Callinan is the company’s chairman. He stepped away from the managing director role last year, and was replaced by Symington, who had worked in various marketing and operational roles for the company since 2000.

Despite its brief flirtation with Johnson & Johnson, the company has generally kept things close to home. It’s never gone the mass-marketing route, instead preferring to build key relationships and trust with the people most likely to influence the buying decision.

Its partners, whose names are listed on every Thermoskin product, include the Australian Institute of Sport and the Australian Physiotherapy Association. The company also trains pharmacists and others likely to influence the buying decision on how to use Thermoskin.

Overseas, the business works with distribution partners and medical professionals.

One exception is the United Kingdom, where business has boomed over the past three years. There, part of the Thermoskin range is sold in supermarkets like Tesco and Sainsbury’s as well as through more traditional routes.

Asked whether his products are likely to be seen on the shelves of Coles and Woolworths anytime soon, Symington is adamant they won’t be.

Nonetheless, he says it’s naive to think the supermarkets won’t have in-house pharmacies sooner or later. This is why the company is looking at other distribution models.

It has a preference for heavy-service models. “Ours is a type of product that requires a bit of servicing from people. Can you get that from pharmacies? Yes. Can you get that from sports retail? Not so much. Can you get it from Coles and Woolworths? Absolutely not.

“Coles and Woolies are about grabbing the milk and bread. Yes, they’re beginning to focus more on health and beauty. But it’s not products like ours.”

The company is mulling over selling directly to consumers through online retail, though nothing has been finalised yet.

Looking to the future, the company has bold ambitions. Currently sold in 18 countries, Symington and his board wants this boosted to 30 within the next three years. It also wants to reduce its reliance on Thermoskin, through finding ways to segment and diversify their customer base, as well as to make the back-end and supply-chain changes needed to compete in the online world.

For now though, business is good. The company made 8% over its budget this year, and turns over $12 million a year.

Thermoskin is used by a range of people, and that bodes well for business, Symington says. “A third of people who buy Thermoskin use it for sport injuries, but the majority use it for arthritis pain management, chronic injuries and work injuries.

“With an aging population, unfortunately people are injuring themselves more. So we’re getting good growth incrementally.”

And last month, the company’s board reaffirmed its commitment to manufacturing in Australia. Which means United Pacific Industries isn't going to stop making products in Australia anytime soon.